JSC Halyk Bank announces a consent solicitation

19 Feb 2020

THIS ANNOUNCEMENT IS NOT FOR DISTRIBUTION TO ANY PERSON LOCATED OR RESIDENT IN ANY JURISDICTION WHERE IT IS UNLAWFUL TO DISTRIBUTE SUCH ANNOUNCEMENT.

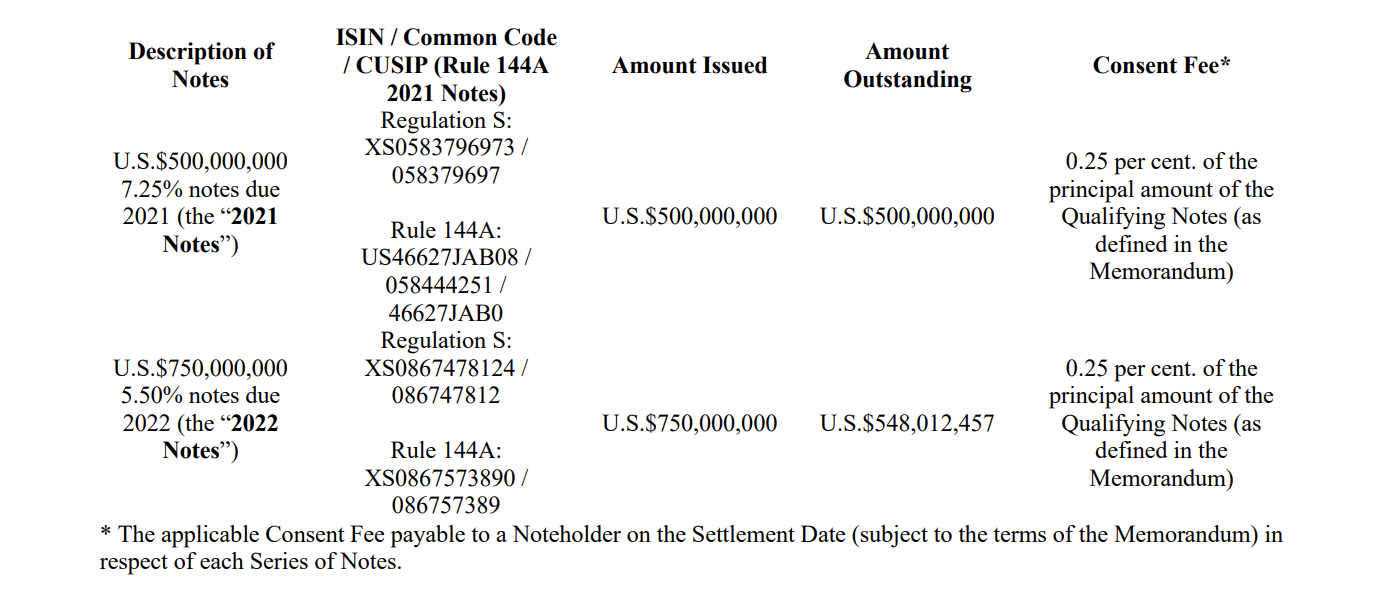

JSC Halyk Bank (the «Issuer») announces a consent solicitation in relation to the outstanding notes detailed in the table below (each of the series of notes referred to below, a «Series», and all outstanding notes of both Series collectively, the «Notes»)

Overview

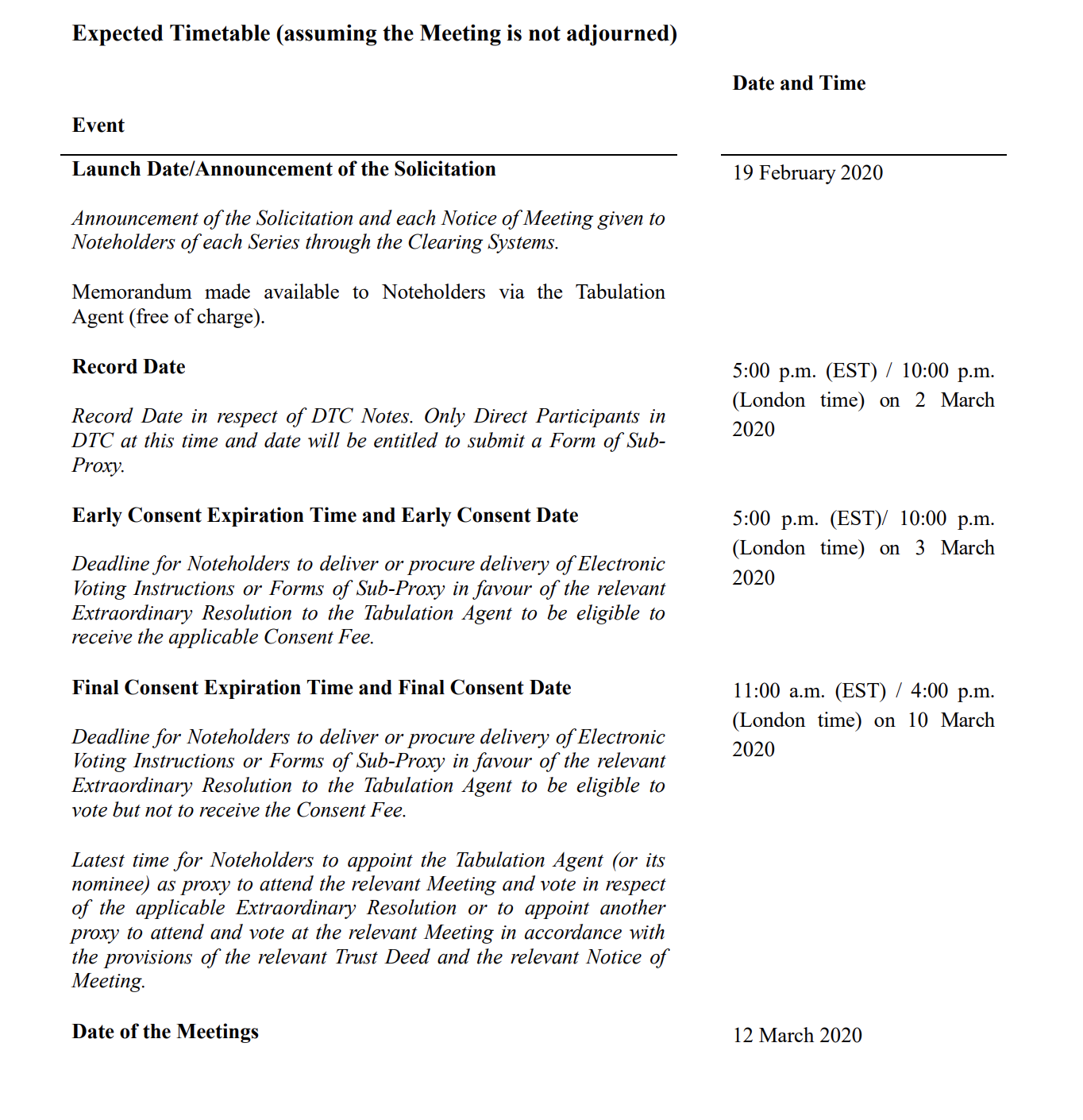

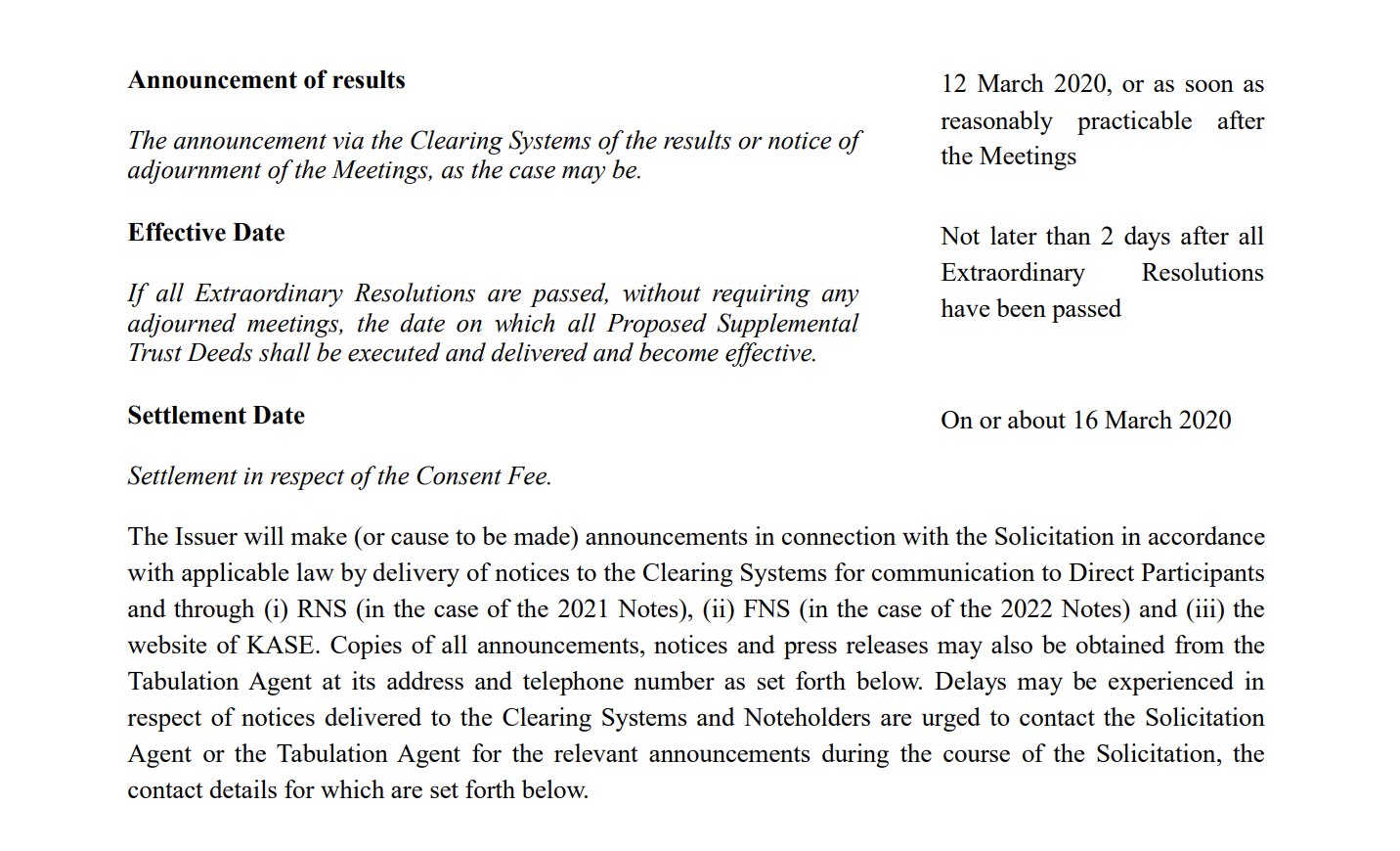

The Issuer has today provided notices of meetings (the “Notices of Meetings«) to solicit proxies (the “Solicitation«) from the beneficial holders of the outstanding Notes (the “Noteholders«) to consider and, if thought fit, pass Extraordinary Resolutions (the “Extraordinary Resolutions«) at meetings of the Noteholders (the “Meetings«) in relation to certain consents and amendments (the “Consents and Amendments«) being sought to: (i) the terms and conditions of the 2021 Notes (the «2021 Note Conditions«) and (ii) the terms and conditions of the 2022 Notes (the «2022 Note Conditions» and, together with the 2021 Note Conditions, the “Conditions«), all as more fully described in the Consent Solicitation Memorandum (the “Memorandum«) dated 19 February 2020 (the “Proposal«).

Subject to the terms of the Proposal and, unless such condition is waived by the Issuer, provided all Extraordinary Resolutions are passed and become effective in accordance with their terms and upon the occurrence of the Effective Date (see «Expected Timetable» below), Noteholders who validly vote in favour of the Proposal in accordance with the Solicitation will be entitled to receive the applicable Consent Fee on the Settlement Date (see «Consent Fee» below). Noteholders are advised to refer to the Memorandum for meanings of capitalised terms used in this announcement, the full terms of the Solicitation and the procedures related thereto.

Each Notice of Meeting convening the Meetings at the offices of Linklaters LLP, One Silk Street, London EC2Y 8HQ, United Kingdom, at which the Extraordinary Resolutions to approve the Proposal and its implementation will be considered and, if thought fit, passed, has been published in accordance with the relevant Conditions

The initial meeting (in respect of the 2021 Notes) will commence at 10:00 a.m. (London time) on 12 March 2020, with the subsequent Meeting (in respect of the 2022 Notes) being held at 10:15 a.m. (London time) on 12 March 2020.

Background to and Rationale for the Proposal

Capitalised terms used, but not defined in this section or in the Memorandum, shall have the meanings given to them in the Conditions or the Trust Deeds.

Introduction

The Issuer, on 28 January 2011, issued U.S.$500,000,000 7.25% Notes due 2021 (the «2021 Notes»), of which U.S.$500,000,000 are currently outstanding. The 2021 Notes were constituted by a trust deed dated 28 January 2021 between the Issuer and the 2021 Notes Trustee.

On 21 December 2012, JSC BTA Bank («BTA») issued U.S.$750,000,000 5.50% Notes due 2022 (the «2022 Notes» and together with the 2021 Notes, the «Notes»), of which U.S.$548,012,457 are currently outstanding. The 2022 Notes were constituted by a trust deed dated 21 December 2012 between BTA and the 2022 Notes Trustee (the «Original Trust Deed»). The obligations of BTA under the 2022 Notes were transferred on 14 November 2014 to JSC Kazkommertsbank («KKB») pursuant to a first supplemental trust deed supplementing the Original Trust Deed, and further transferred from KKB to the Issuer on 27 July 2018 following the merger of KKB into the Issuer (with the Issuer being the surviving entity) pursuant to a second supplemental trust deed, (together with the Original Trust Deed and the first supplemental trust deed, the «2022 Trust Deed»). The Issuer consequently became the issuer of the 2022 Notes.

The Issuer is proposing hereby to (i) make certain amendments to the «Limitation on Payment of Dividends» covenant in both the 2021 Notes Conditions and the 2022 Notes Conditions (Condition 5.2 and Condition 5© respectively) (the «2021 Covenant» and the «2022 Covenant» and together, the «Covenants»), in order to, inter alia, align the Covenants with the Issuer's current dividend policy and (ii) to amend the definition of «Fair Market Value» in the 2022 Note Conditions so that it is aligned with the corresponding definition in the 2021 Note Conditions, all as further set out below in the Proposal below.

The Proposal

(1) Limitation on Payment of Dividends Covenant (2021 Notes and 2022 Notes)

The Issuer’s dividend policy is set out in its updated dividend policy published on 24 June 2019. Chapter 3, clause 4 of this policy provides as follows:

«When determining dividend amounts to be recommended to the general meeting (one per common share), the Bank's Board of Directors shall consider the Bank's equity as well as proceed from the precondition that the amount used for payment of dividends on common shares shall be from 50% to 100% of total net profits for the reporting year in accordance with the Bank's audited consolidated financial statements. To ensure the dividends payment, the Bank shall additionally use monetary resources from dividend payments received by the Bank from its subsidiaries.»

In addition to its stated dividend policy, the Issuer, when determining its dividend pay-out ratio, takes into account certain other considerations such as dividend limitations under Kazakh law and the Issuer’s other contractual obligations towards third parties, as well as maintenance of international credit ratings and capital adequacy ratios.

The Issuer is currently restricted under the Covenants from paying dividends or other distributions in excess of 50% of the Issuer's net income for the period in respect of which the dividends are paid. In order to align the provisions of the Covenants with its updated dividend policy, the Issuer proposes that the Covenants should be amended to allow payment of up to 100% of the Issuer's net income for the period in respect of which the dividends are being paid or the distribution is being made. The Issuer also proposes to clarify that the calculation of the net income will be based on the audited consolidated financial statements of the Issuer and its consolidated Subsidiaries.

Furthermore, the Covenants currently prohibit the Issuer from making any other distributions (whether by way of redemption, acquisition or otherwise) in respect of share capital more frequently than once during any calendar year. This currently limits the Issuer's ability to conduct share redemptions and buybacks during the course of the year as and when opportunities or requirements present themselves or as part of operations involving the Issuer's equity. The Issuer therefore proposes to remove the restriction on its ability to make such other distributions more than once a year. This will not, however, affect the frequency with which the Issuer may make dividend payments, which will continue to be restricted to not more than once during the calendar year. Moreover, the Issuer's ability to make other distributions, whether by redemption, acquisition or otherwise in respect of share capital, when combined with any dividend payments, will continue to be capped by virtue of the Covenants (as amended pursuant to this Proposal) at 100% of the Issuer's and its consolidated Subsidiaries» consolidated net income for the period in respect of which the dividends are being paid or the distribution is being made.

(2) Limitations on Certain Transactions Covenant — Definition of «Fair Market Value» (2022 Notes only)

In order to rationalise the terms of its different outstanding debt securities and to facilitate the day-to-day management of its obligations, the Issuer wishes to align the definition of «Fair Market Value» in the 2022 Note Conditions with the equivalent definition in the 2021 Note Conditions such that the determination of the Fair Market Value for the purposes of Condition 5(b) (Limitations on Certain Transactions) of the 2022 Note Conditions will be made by the Auditors of the Issuer or other independent appraiser of international repute if the 2022 Notes Trustee requires such determination to be made.

Summary of the Proposal

Set out below is a summary of the key changes that are the subject of the Proposal. It is not intended to be a full description of all the changes and Noteholders are referred to, and should carefully review, the Proposal in full, as set out under «Terms of the Consent Solicitation — General» of the Memorandum.

(1) Limitation on Payment of Dividends Covenant (2021 Notes and 2022 Notes)

Each of Condition 5.2 (Limitation on Payment of Dividends) of the 2021 Note Conditions and Condition 5© (Limitation on Payment of Dividends) of the 2022 Note Conditions will be amended such that (i) the IFRS net income threshold is increased from 50% to 100%, (ii) such threshold is calculated by reference to the IFRS net income of the Issuer and its consolidated Subsidiaries for the relevant period and (iii) the restriction on the frequency of payments of dividends (in cash or otherwise) and making of other distributions (whether by way of redemption, acquisition or otherwise) will now only apply to payments of dividends (in cash or otherwise).

(2) Limitations on Certain Transactions Covenant — Definition of «Fair Market Value» (2022 Notes only)

The definition of «Fair Market Value» in the 2022 Note Conditions will be aligned with the respective definition in the 2021 Note Conditions such that the determination of the Fair Market Value for the purposes of Condition 5(b) (Limitations on Certain Transactions) of the 2022 Note Conditions will be made by the Auditors of the Issuer or other independent appraiser of international repute if the 2022 Notes Trustee requires such determination to be made.

Consent Fee

Noteholders who validly submit an Electronic Voting Instruction or who validly submit a Form of SubProxy, as applicable, in favour of the relevant Extraordinary Resolution that is received by the Tabulation Agent on or prior to the Early Consent Expiration Time and who have not validly revoked their Electronic Voting Instruction or Form of Sub-Proxy, as applicable, will be entitled to receive the applicable Consent Fee, provided that all Extraordinary Resolutions that are the subject of the Proposal are duly passed and become effective in accordance with their terms and the Effective Date has occurred (unless such condition is waived by the Issuer).

Unless such condition is waived by the Issuer, the applicable Consent Fee will be paid as consideration for the relevant Noteholders» approval of the relevant Extraordinary Resolution only if, and provided that, the Extraordinary Resolutions relating to both Series are passed. Unless such condition is waived by the Issuer, no Consent Fee shall be payable to any Noteholder to the extent either of the Extraordinary Resolutions is not duly passed at the relevant Meeting or, as the case may be, Adjourned Meeting, notwithstanding that the remaining Extraordinary Resolution was duly passed at the relevant Meeting or, as the case may be, Adjourned Meeting.

If either of the Proposed Supplemental Trust Deeds is entered into and delivered by the Issuer and the relevant Trustee, the applicable Consent Fee will be paid as consideration for the relevant Noteholders» approval of the relevant Extraordinary Resolution.

Revocation of instructions

Noteholders who have submitted Electronic Voting Instructions or Forms of Sub-Proxy, as applicable, have a right to revoke such instruction in the following circumstances only: (i) if required by law or permitted by the relevant Trust Deed (as applicable), or (ii) if the Issuer considers that any modification or amendment (excluding any material modification or amendment to the relevant Extraordinary Resolution which may not be made during the relevant Meeting notice period) is materially prejudicial to Noteholders compared with the initial terms of the Proposal and Solicitation, as more fully described in the Memorandum.

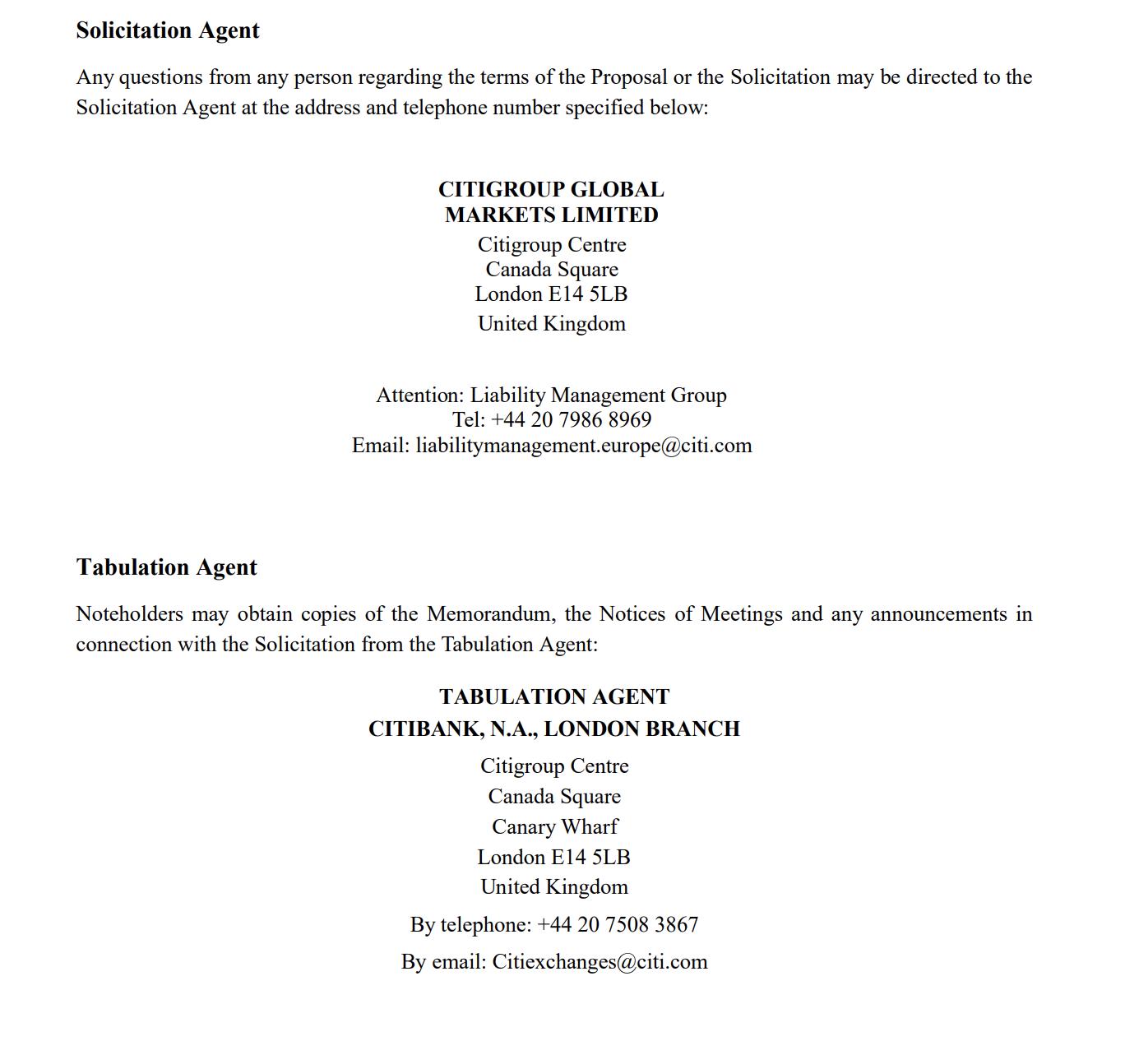

None of the Solicitation Agent, the Tabulation Agent, the Trustees (as defined in the Memorandum) or the Issuer takes any responsibility for the contents of this announcement and none of the Issuer, the Solicitation Agent, the Tabulation Agent, the Trustees or any of their respective directors, officers, employees or affiliates makes any representation or recommendation whatsoever regarding the Solicitation, or expresses any opinion as to whether Noteholders should participate in the Solicitation or vote in favour of or against the relevant Extraordinary Resolution. This announcement must be read in conjunction with the Memorandum. This announcement and the Memorandum contain important information which should be read carefully before any decision is made with respect to the Solicitation. If any Noteholder is in any doubt as to the action it should take, it is recommended to seek its own advice, including as to any tax consequences, from its stockbroker, bank manager, solicitor, accountant or other independent adviser.

Within the United Kingdom, this announcement is directed only at persons having professional experience in matters relating to investments who fall within the definition of «investment professionals» in Article 19(5) of the Financial Services and Markets Act 2000 (Financial Promotion) Order 2005 («relevant persons»). The investment or investment activity to which this announcement relates is only available to and will only be engaged in with relevant persons and persons who receive this announcement who are not relevant persons should not rely or act upon it.

This announcement is not a solicitation of consent with respect to any Notes and does not constitute an invitation to participate in the Solicitation in or from any jurisdiction in or from which, or to or from any person to or from whom, it is unlawful to make such invitation under applicable securities laws. The Solicitation is being made solely pursuant to the Memorandum, which sets forth a detailed statement of the terms of the Solicitation.

The distribution of this announcement in certain jurisdictions may be restricted by law. Persons into whose possession this announcement comes are required to inform themselves about, and to observe, any such restrictions.